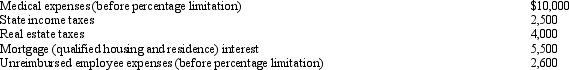

Cindy,who is single and has no dependents,has adjusted gross income of $50,000 in 2012.Her potential itemized deductions are as follows:

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

What is the amount of Cindy's AMT adjustment for itemized deductions for 2012?

Definitions:

Summary Reports

Concise documents that outline the main points of a longer report or discussion.

Academic Settings

Environments related to educational institutions like schools or universities, where learning, teaching, and research activities occur.

Business Settings

The environments or contexts within which commercial operations or professional interactions occur.

Informational Reports

Documents that provide facts and analysis without any recommendations; often used to update or inform on a situation.

Q23: Tariq sold certain U.S.Government bonds and State

Q55: Under the taxpayer-use test for a §

Q60: A provision in the law that compels

Q72: Realizing that providing for a comfortable retirement

Q76: In 2012,Louise incurs circulation expenses of $330,000

Q93: How does the FICA tax compare to

Q94: Samuel,an individual who has been physically handicapped

Q139: Beth sells investment land (adjusted basis of

Q140: The adjusted basis of property that is

Q141: Pam,a widow,makes cash gifts to her four