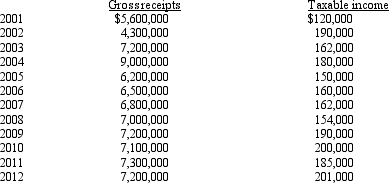

Sage,Inc.,has the following gross receipts and taxable income:

Is Sage,Inc.,subject to the AMT in 2012?

Is Sage,Inc.,subject to the AMT in 2012?

Definitions:

Hourly Wage

Compensation paid to employees based on the number of hours worked, typically expressed as an amount of money per hour.

Parking

The act of stopping and disengaging a vehicle and leaving it unoccupied.

Implicit Costs

Additional costs that do not appear on the financial statements of a company. These costs include items such as the opportunity cost of capital.

Economic Profits

Profits that exceed the opportunity costs of all resources used by the firm, including both explicit and implicit costs.

Q19: Edward,age 52,leased a house for one year

Q31: A FIFO method is applied to general

Q44: Realized gain or loss is measured by

Q45: Which of the following statements concerning the

Q48: Frank,a recently retired FBI agent,pays job search

Q53: Kelly inherits land which had a basis

Q67: Grace's sole source of income is from

Q88: The purpose of the tax credit for

Q96: Brad,who uses the cash method of accounting,lives

Q116: As a matter of administrative convenience,the IRS