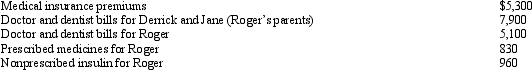

Roger is employed as an actuary.For calendar year 2012,he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Definitions:

Operating Lease

A contractual arrangement giving the lessee temporary use of the property, with continued ownership of the property by the lessor.

Capital Lease

A capital lease is a lease agreement that transfers substantially all the risks and benefits of ownership from the lessor to the lessee.

Bargain Purchase Option

A provision in a lease agreement that allows the lessee to purchase the leased asset at a price significantly below its fair market value.

Economic Life

The estimated period over which an asset is expected to be useful in generating revenue or its intended purpose.

Q23: In 2012,Arnold invests $80,000 for a 20%

Q60: The earned income credit is available only

Q61: Brian,a self-employed individual,pays state income tax payments

Q74: Melba gives her niece a drill press

Q83: If a taxpayer is required to recapture

Q108: On March 3,2012,Sally purchased and placed in

Q115: Because the law is complicated,most individual taxpayers

Q117: Elsie lives and works in Detroit.She is

Q124: Mona purchased a business from Judah for

Q126: Jacob is a landscape architect who works