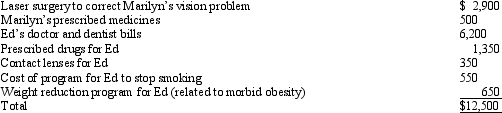

Marilyn,Ed's daughter who would otherwise qualify as his dependent,filed a joint return with her husband Henry.Ed,who had AGI of $150,000,incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

Definitions:

Level of Significance

Refers to the probability threshold beyond which a null hypothesis is rejected in statistical testing, typically set at 0.05 or 5%.

Obtained Value

The actual value or result that is observed or calculated during an experiment or statistical analysis.

Critical Value

A threshold value used in hypothesis testing, which, when exceeded by the test statistic, results in the rejection of the null hypothesis.

Independent-Samples T Test

A statistical test used to compare the means of two independent groups to determine if there is a statistically significant difference between them.

Q10: BlueCo incurs $700,000 during the year to

Q12: Paige is the sole shareholder of Citron

Q28: Roger owns and actively participates in the

Q36: Mitchell owned an SUV that he had

Q39: Mindy paid an appraiser to determine how

Q61: Brian,a self-employed individual,pays state income tax payments

Q64: Rex and Dena are married and have

Q64: Herbert is the sole proprietor of a

Q66: Elbert gives stock worth $28,000 (no gift

Q86: Qualified research and experimentation expenditures are not