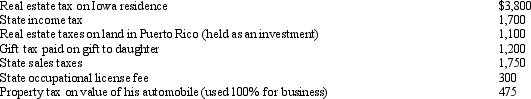

During 2012,Hugh,a self-employed individual,paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

Definitions:

Primary Sources

Original documents, recordings, or other sources of information created at the time under study, used as a direct source of information about a historical event or period.

Emotional Involvement

The degree to which an individual is emotionally engaged or invested in a particular situation, activity, or relationship.

Extended Period

A length of time that is longer than usual or expected.

Primary Group

A small social group characterized by close, personal, and enduring relationships, which significantly influence the attitudes and ideals of those involved.

Q2: Marcia borrowed $110,000 to acquire a parcel

Q19: The amount of the deduction for medical

Q22: Harry earned investment income of $18,500,incurred investment

Q29: Vail owns interests in a beauty salon,a

Q31: Brian makes gifts as follows:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4131/.jpg"

Q51: Ned,a college professor,owns a separate business (not

Q85: Which of the following factors should be

Q87: Both traditional and Roth IRAs possess the

Q112: An election to use straight-line under ADS

Q120: Smoke,Inc.,provides you with the following information:<br> <img