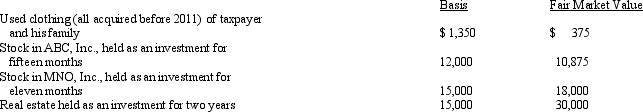

Zeke made the following donations to qualified charitable organizations during 2012:  The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2012 is:

The used clothing was donated to the Salvation Army; the other items of property were donated to Eastern State University.Both are qualified charitable organizations.Disregarding percentage limitations,Zeke's charitable contribution deduction for 2012 is:

Definitions:

Co-ownership

The joint ownership of a property or asset by two or more parties who share the benefits and liabilities associated with it.

Married Couples

are two individuals legally wed to each other and recognized as a married unit under the law, with various shared legal rights and obligations.

Broker

An individual or firm that acts as an intermediary between buyers and sellers, typically in financial transactions, real estate, or investment deals.

Agent

represents a person authorized to act on behalf of another, known as the principal, in dealings with third parties, typically in commercial transactions or contractual agreements.

Q2: In 2012,Allison drove 800 miles to volunteer

Q3: Which of the following expenses,if any,qualify as

Q5: Charles owns a business with two separate

Q26: If a taxpayer purchases taxable bonds at

Q26: The recognized gain for regular income tax

Q60: Discuss the criteria used to determine whether

Q68: The deduction for personal and dependency exemptions

Q76: In preparing an income tax return,the use

Q81: If a taxpayer purchases a business and

Q122: Robin,who is a head of household and