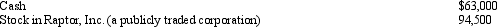

During 2012,Ralph made the following contributions to the University of Oregon (a qualified charitable organization) :  Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2012 is $189,000.What is Ralph's charitable contribution deduction for 2012?

Ralph acquired the stock in Raptor,Inc.,as an investment fourteen months ago at a cost of $42,000.Ralph's AGI for 2012 is $189,000.What is Ralph's charitable contribution deduction for 2012?

Definitions:

Authenticity

The quality of being genuine, real, or true, not copied or false.

Unobtrusive Measures

Research methods that do not involve direct interaction with research subjects, hence not influencing their behavior.

Behavior Observation

The systematic recording of observable behaviors or responses in natural or controlled settings, often used in psychological and sociological research.

Peer Review

The process of evaluating the quality, validity, and relevance of scholarly work by other experts in the same field.

Q10: Sergio was required by the city to

Q46: Grape Corporation purchased a machine in December

Q61: What is the easiest way for a

Q72: Sam,who earns a salary of $400,000,invested $160,000

Q76: In 2012,Louise incurs circulation expenses of $330,000

Q77: Discuss the effect of a liability assumption

Q89: Amy works as an auditor for a

Q103: A taxpayer who claims the standard deduction

Q122: Robin,who is a head of household and

Q123: The proposed flat tax:<br>A) Would eliminate the