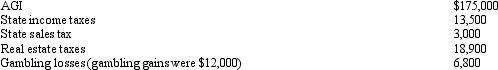

Paul,a calendar year married taxpayer,files a joint return for 2012.Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

Definitions:

Weighted Average

A calculation that takes into account the varying degrees of importance of the numbers in a dataset, often used in accounting to value inventory.

Common Shares

Units of ownership interest or equity in a corporation that entitle their holder to a share of the corporation's earnings and give them the right to vote.

Earnings Per Share

A financial metric that indicates the portion of a company's profit allocated to each outstanding share of common stock.

Preferred Shares

A type of ownership in a corporation that has a higher claim on assets and earnings than common stock and often pays dividends at a fixed rate.

Q1: On May 2,2012,Karen placed in service a

Q3: Judy owns a 20% interest in a

Q36: Jackson gives his supervisor a $30 box

Q40: Kelly,an unemployed architect,moves from Boston to Phoenix

Q42: In 2012,Dena traveled 545 miles for specialized

Q47: In the year of her death,Maria made

Q88: Which of the following statements is correct?<br>A)

Q114: Which,if any,of the following transactions will decrease

Q137: Various tax provisions encourage the creation of

Q138: Robert sold his ranch which was his