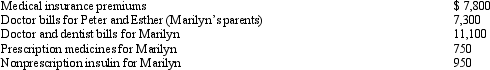

Marilyn is employed as an architect.For calendar year 2012,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

Treatment

Medical care given to a patient for an illness or injury, aimed at relieving symptoms or curing the condition.

Experimental Variable

Factor of the experiment being tested.

Disinfectant

Chemical agents used to destroy or inhibit the growth of harmful organisms, especially in non-living objects and surfaces.

Anti-Cancer Drug

Medications used to prevent, slow down, or treat cancer by various mechanisms, including interfering with cancer cell growth and reproduction.

Q6: Investment income can include gross income from

Q13: Norm's car,which he uses 100% for personal

Q39: Describe the general rules that limit the

Q41: Certain situations exist where the wage-bracket table

Q44: The American Opportunity credit is available per

Q73: Celia and Amos,who are married filing jointly,have

Q77: Linda owns investments that produce portfolio income

Q87: Qualifying tuition expenses paid from the proceeds

Q93: Ryan performs services for Jordan.Which,if any,of the

Q112: Annette purchased stock on March 1,2012,for $165,000.At