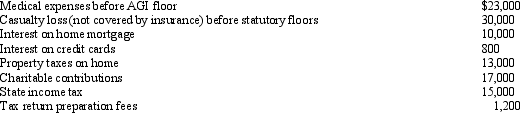

For calendar year 2012,Jon and Betty Hansen file a joint return reflecting AGI of $280,000.They incur the following expenditures:

What is the amount of itemized deductions the Hansens may claim?

What is the amount of itemized deductions the Hansens may claim?

Definitions:

Vitamin B12

An essential vitamin necessary for the normal functioning of the brain and nervous system, and for the formation of blood.

Pernicious Anemia

An autoimmune disorder that prevents the body from absorbing vitamin B12, leading to a severe type of anemia.

Vitamin A

An essential fat-soluble vitamin important for vision, immune function, and skin health, occurring naturally in foods like carrots, spinach, and liver.

Night Blindness

A condition characterized by difficulty seeing in low light or darkness, often due to vitamin A deficiency.

Q36: Eric makes an installment sale of a

Q43: A calendar year taxpayer files his 2011

Q72: Chad pays the medical expenses of his

Q76: The credit for child and dependent care

Q84: For purposes of computing the deduction for

Q84: A loss is not allowed for a

Q85: White Company acquires a new machine (seven-year

Q87: In determining whether a debt is a

Q94: Jermaine and Kesha are married,file a joint

Q103: Discuss the reason for the inclusion amount