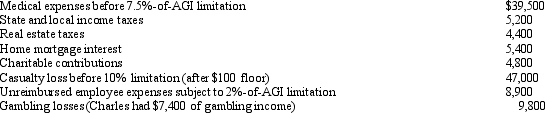

Charles,who is single,had AGI of $400,000 during 2012.He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Property, Plant & Equipment

Tangible long-lived assets owned by a business for the purpose of producing goods or services and not intended for sale during the normal course of business.

Land Improvements

Enhancements made to a parcel of land to increase its value or utility, such as landscaping, fencing, or installing utilities, which are capitalized and depreciated over time.

Lease Improvements

These are modifications made to rental premises in order to tailor the space to the needs of the tenant.

Straight-Line Method

A method of allocating an asset's cost evenly over its useful life, commonly used in depreciation and amortization calculations.

Q2: During the year,Purple Corporation (a U.S.Corporation)has U.S.-source

Q12: A medical expense does not have to

Q30: Joe,a cash basis taxpayer,took out a 12-month

Q36: Which,if any,of the following correctly describes the

Q54: Why is there no AMT adjustment for

Q54: Tom participates for 300 hours in Activity

Q60: A taxpayer may carry any NOL incurred

Q74: Prior to the effect of tax credits,Wayne's

Q83: Tara purchased a machine for $40,000 to

Q110: Discuss the tax consequences of listed property