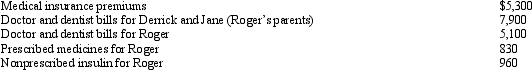

Roger is employed as an actuary.For calendar year 2012,he had AGI of $130,000 and paid the following medical expenses:  Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Derrick and Jane would qualify as Roger's dependents except that they file a joint return.Roger's medical insurance policy does not cover them.Roger filed a claim for $4,800 of his own expenses with his insurance company in November 2012 and received the reimbursement in January 2013.What is Roger's maximum allowable medical expense deduction for 2012?

Definitions:

Cash Disbursements

The process of paying out money from a business or organization, typically for expenses or obligations.

Cost of Goods Sold

The direct costs attributable to the production of the goods sold by a company, including both materials and labor costs.

Merchandise Inventory

The total value of a retailer's goods that are available for sale.

Cash Receipts

The money received by a business during a specified period, including revenue from sales, loan proceeds, and investment income.

Q4: When Congress enacts a tax cut that

Q27: Briana lives in one state and works

Q31: Brian makes gifts as follows:<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4131/.jpg"

Q46: A statutory employee is not a common

Q105: Taylor inherited 100 acres of land on

Q108: The AMT adjustment for research and experimental

Q109: Keosha acquires 10-year personal property to use

Q121: The components of the general business credit

Q128: Which of the following statements is false?<br>A)

Q149: The value added tax (VAT)has had wide