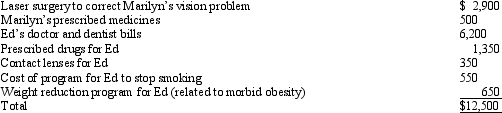

Marilyn,Ed's daughter who would otherwise qualify as his dependent,filed a joint return with her husband Henry.Ed,who had AGI of $150,000,incurred the following expenses:  Ed has a medical expense deduction of:

Ed has a medical expense deduction of:

Definitions:

Marginal Revenue

The supplementary financial gain obtained through the sale of one more unit of a good or service.

Profit

The financial gain obtained when the amount earned from a business activity exceeds the expenses, costs, and taxes.

Marginal Revenue

The profit increment a business achieves through the sale of one extra unit of its offerings.

Macaws

Large, brightly colored parrots with long tails and powerful beaks, native to Central and South America.

Q18: List the taxpayers that are subject to

Q33: Tom owns and operates a lawn maintenance

Q33: Kay had percentage depletion of $119,000 for

Q47: Which,if any,of the following is a typical

Q51: A worker may prefer to be treated

Q74: In 2012,Emily invests $100,000 in a limited

Q76: Which of the following assets would be

Q84: Assuming no phaseout,the AMT exemption amount for

Q119: Which of the following best describes the

Q119: Tired of renting,Dr.Smith buys the academic robes