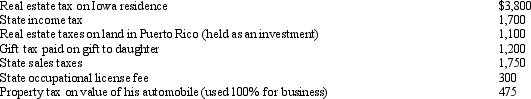

During 2012,Hugh,a self-employed individual,paid the following amounts:  What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

What is the maximum amount Hugh can claim as taxes in itemizing deductions from AGI?

Definitions:

Influentials

Individuals who have the power to affect purchase decisions of others because of their authority, knowledge, position, or relationship.

Evangelists

Individuals who passionately advocate for a brand, product, or service, often influencing others based on their personal experiences or beliefs.

Complex Product

A product with multiple components and features, often requiring detailed information or demonstrations to understand its use fully.

Social Network

An online platform or community where people connect, interact, and share content with others who have similar interests, backgrounds, or real-life connections.

Q11: Employers are encouraged by the work opportunity

Q18: A taxpayer who claims the standard deduction

Q23: In 2012,Arnold invests $80,000 for a 20%

Q34: Without obtaining an extension,Olivia files her income

Q41: Bill is employed as an auditor by

Q46: Grape Corporation purchased a machine in December

Q65: Tan Company acquires a new machine (ten-year

Q79: Pat generated self-employment income in 2012 of

Q81: If a taxpayer purchases a business and

Q88: Upon audit by the IRS,Faith is assessed