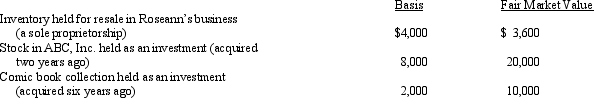

In 2012,Roseann makes the following donations to qualified charitable organizations:  The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2012 is:

The ABC stock and the inventory were given to Roseann's church,and the comic book collection was given to the United Way.Both donees promptly sold the property for the stated fair market value.Disregarding percentage limitations,Roseann's charitable contribution deduction for 2012 is:

Definitions:

Internet

A global network of computers that provides a wide range of information and communication facilities, consisting of interconnected networks using standardized communication protocols.

Leisure Time

Free time available to a person apart from commitments to work or domestic chores, often used for relaxation or hobbies.

Commodification

The process by which it becomes possible to buy and sell a particular good or service.

Recreational Activities

Activities participated in for enjoyment, relaxation, or leisure, often distinct from professional or obligatory tasks.

Q22: All listed property is subject to the

Q23: What is the relationship between taxable income

Q24: Faith just graduated from college and she

Q41: Bill is employed as an auditor by

Q44: The Federal gas-guzzler tax applies only to

Q47: Which of the following itemized deductions definitely

Q69: Art owns significant interests in a hardware

Q86: Rustin bought used 7-year class property on

Q100: For purposes of computing the deduction for

Q105: Jed is an electrician.Jed and his wife