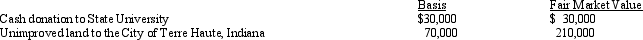

Karen,a calendar year taxpayer,made the following donations to qualified charitable organizations in 2012:  The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

The land had been held as an investment and was acquired 4 years ago.Shortly after receipt,the City of Terre Haute sold the land for $210,000.Karen's AGI is $450,000.The allowable charitable contribution deduction is:

Definitions:

Global World

A term referring to the interconnectedness of nations through trade, technology, politics, and culture, often emphasizing collective challenges and opportunities.

Symbols

Objects, figures, or colors used to represent ideas, concepts, or other abstractions.

Sounds of Language

The auditory elements used in speech, including phonemes, tones, and intonation, which contribute to linguistic communication.

Anthropologists

Researchers focused on analyzing the development, cultures, and societal structures of humans.

Q12: On August 20,2012,May signed a 10-year lease

Q29: Inez's adjusted basis for 9,000 shares of

Q39: What is the purpose of the AMT

Q58: A corporation which makes a loan to

Q66: Letha incurred a $1,600 prepayment penalty to

Q72: Ashley and Matthew are husband and wife

Q78: Bruce,who is single,had the following items for

Q87: In determining whether a debt is a

Q89: An employee with outside income may be

Q98: Carlos purchased an apartment building on November