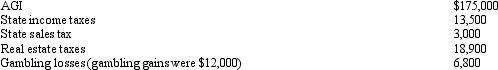

Paul,a calendar year married taxpayer,files a joint return for 2012.Information for 2012 includes the following:  Paul's allowable itemized deductions for 2012 are:

Paul's allowable itemized deductions for 2012 are:

Definitions:

Experienced Nurse

A nurse who has gained a wealth of knowledge, skills, and judgment through extensive practical experience in nursing over several years.

Patient Education

Providing health-related information and instructions to patients to improve knowledge, health outcomes, and adherence to treatments.

Nursing Practice

The professional care and services provided by nurses to support the health and well-being of patients, including medical interventions and emotional support.

Health Care Costs

The expenses associated with medical procedures, treatments, drugs, and other health-related services.

Q48: One of the motivations for making a

Q70: When a net operating loss is carried

Q72: Realizing that providing for a comfortable retirement

Q77: Taxes assessed for local benefits,such as a

Q88: A personal casualty loss deduction may be

Q96: Felicia,a recent college graduate,is employed as an

Q99: Under the right circumstances,a taxpayer's meals and

Q111: Depreciation on a building used for research

Q131: Henry entertains several of his key clients

Q140: As to meeting the time test for