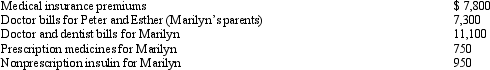

Marilyn is employed as an architect.For calendar year 2012,she had AGI of $204,000 and paid the following medical expenses:

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Peter and Esther would qualify as Marilyn's dependents except that they file a joint return.Marilyn's medical insurance policy does not cover them.Marilyn filed a claim for reimbursement of $6,000 of her own expenses with her insurance company in December 2012 and received the reimbursement in January 2013.What is Marilyn's maximum allowable medical expense deduction for 2012?

Definitions:

College

An institution of higher education offering undergraduate or graduate degrees.

Factor of Production

A factor of production is an economic resource utilized in the creation of goods or services, including labor, land, capital, and entrepreneurship.

Total Income

The sum of all wages, salaries, profits, interest payments, rents, and other forms of earnings received by an individual or business in a given period.

Compensation of Employees

Refers to the total remuneration, in cash or in kind, payable by an employer to an employee in return for work done.

Q29: Inez's adjusted basis for 9,000 shares of

Q33: Peggy uses a delivery van in her

Q43: Motel buildings are classified as residential rental

Q50: The IRS is required to redetermine the

Q54: In a farming business,MACRS straight-line cost recovery

Q64: In 2013, Marci is considering starting a

Q111: Eula owns a mineral property that had

Q114: The cost of a covenant not to

Q118: Under what conditions is it permissible,from an

Q122: Robin,who is a head of household and