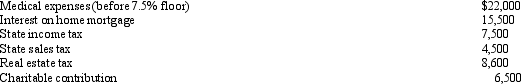

George is single,has AGI of $255,300,and incurs the following expenditures in 2012.

What is the amount of itemized deductions George may claim?

What is the amount of itemized deductions George may claim?

Definitions:

Whiskey Ring

A scandal in the 1870s involving government officials and distillers in the United States to defraud the government of taxes on whiskey.

Ulysses Grant

The 18th President of the United States (1869-1877) and a prominent Union general during the American Civil War, known for his leadership and efforts to reunify the nation.

Q2: Can AMT adjustments and preferences be both

Q10: The tax law allows an income tax

Q47: Which,if any,of the following is a typical

Q54: A major disadvantage of a flat tax

Q69: Ken is married to a nonemployed spouse

Q71: An individual generally may claim a credit

Q85: In connection with facilitating the function of

Q111: Bradley has two college-age children,Clint,a freshman at

Q115: Which of the following statements is correct?<br>A)

Q118: A taxpayer just changed jobs and incurred