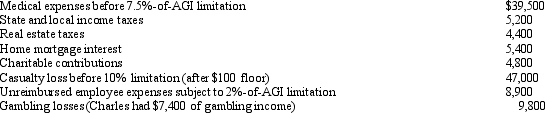

Charles,who is single,had AGI of $400,000 during 2012.He incurred the following expenses and losses during the year.

Compute Charles's total itemized deductions for the year.

Compute Charles's total itemized deductions for the year.

Definitions:

Financing Activities

Transactions related to funding the company, including issuing equity, borrowing loans, or paying dividends.

Investing Activities

Investing activities involve the purchase and sale of long-term assets and other investments, not including cash equivalents, reflected in the cash flow statement of a company.

Statement Of Cash Flows

A report that captures the effects of changes in balance sheet accounts and income on the availability of cash and cash equivalents.

Equipment

Tangible property other than land or buildings that is used in operations of a business, such as machinery or office furniture.

Q14: John gave $1,000 to a family whose

Q24: A VAT (value added tax):<br>A) Is regressive

Q28: Maria traveled to Rochester,Minnesota,with her son,who was

Q45: When a state decouples from a Federal

Q48: Frank,a recently retired FBI agent,pays job search

Q67: Which of the following statements regarding the

Q71: Percentage depletion enables the taxpayer to recover

Q110: Lois received nontaxable stock rights with a

Q118: Ashlyn is subject to the AMT in

Q150: Describe the relationship between the recovery of