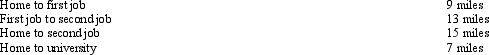

Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2012,his mileage was as follows:

How much can Rod claim for mileage?

How much can Rod claim for mileage?

Definitions:

Cohabiting family

A family unit consisting of an unmarried couple living together in a long-term relationship, potentially with children.

Post-traditional family

A family structure that diverges from conventional societal norms, such as single-parent families or same-sex parents.

Dating

The process whereby two people meet socially for companionship beyond the level of friendship, often with the aim of assessing each other's suitability as a partner in an intimate relationship or marriage.

Divorce

The legal termination of a marriage by a court or other competent body.

Q32: Durell owns a construction company that builds

Q55: Petal,Inc.is an accrual basis taxpayer.Petal uses the

Q63: If property tax rates are not changed,the

Q71: In the current year,Bo accepted employment with

Q76: Amy lives and works in St.Louis.In the

Q85: Georgia contributed $2,000 to a qualifying Health

Q97: Diane purchased a factory building on November

Q102: A cash basis taxpayer took an itemized

Q110: Ava holds two jobs and attends graduate

Q152: A Federal excise tax is still imposed