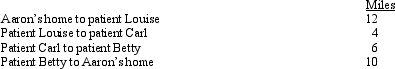

Aaron is a self-employed practical nurse who works out of his home.He provides nursing care for disabled persons living in their residences.During the day he drives his car as follows.  Aaron's deductible mileage for each workday is:

Aaron's deductible mileage for each workday is:

Definitions:

Urban Areas

Regions characterized by high population density and vast human features in comparison to areas surrounding them, usually referring to cities or towns.

Landowners

Individuals or entities that hold legal ownership of land or property.

Atlantic World

A term used to describe the interconnected web of social, economic, and political relationships across the Atlantic Ocean, primarily between Europe, Africa, and the Americas from the late 15th to the early 19th century.

Interdependent Web

Describes a complex system where all elements are interconnected and depend on each other for survival or function.

Q23: Taxpayer's home was destroyed by a storm

Q25: A lack of compliance in the payment

Q26: Which of the following expenses associated with

Q70: No state has offered an income tax

Q74: Amber Machinery Company purchased a building from

Q77: A taxpayer who claims the standard deduction

Q78: Bruce,who is single,had the following items for

Q81: Land improvements are generally not eligible for

Q114: Which,if any,of the following transactions will decrease

Q129: Ralph made the following business gifts during