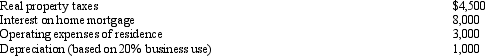

For the current year,Horton was employed as a deputy sheriff of a county.He had AGI of $50,000 and the following unreimbursed employee expenses:

How much of these expenses are allowed as deductions from AGI?

How much of these expenses are allowed as deductions from AGI?

Definitions:

Isolated Type

Denotes a classification or category typically used in psychology or psychiatry to describe individuals who prefer solitude and show little interest in social interactions.

Chronic Alcoholic

An individual suffering from alcoholism for a long duration, showing a consistent pattern of excessive drinking despite negative consequences.

Anxious Attachment

An anxious, uncertain, and clingy style of attachment; in some models, includes a negative view of the self.

Harry Harlow

An American psychologist best known for his research on social isolation, maternal-separation, and dependency needs of rhesus monkeys, which played a significant role in understanding human emotional and social development.

Q30: Chris receives a gift of a passive

Q38: Sarah's employer pays the hospitalization insurance premiums

Q39: The employees of Mauve Accounting Services are

Q59: Elaine,the regional sales director for a manufacturer

Q78: Legal fees incurred in connection with a

Q79: The cost recovery period for new farm

Q94: Are all personal expenses disallowed as deductions?

Q96: A cash basis taxpayer who charges an

Q98: Mallard Corporation furnishes meals at cost to

Q124: How can the positive AMT adjustment for