Related Questions

Q22: On his 2012 income tax return,Logan omitted

Q41: Bill is employed as an auditor by

Q42: In 2012,Dena traveled 545 miles for specialized

Q44: Landscaping expenditures on new rental property are

Q46: Interest paid or accrued during the tax

Q59: Mother participated in a qualified state tuition

Q71: David,a single taxpayer,took out a mortgage on

Q75: Janice is single,had gross income of $38,000,and

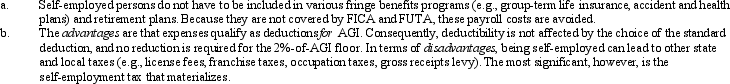

Q99: Ron and Tom are equal owners in

Q141: For purposes of the § 267 loss