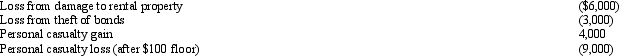

In 2012,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Walsh-Healy Public Contracts Act

A United States federal law that establishes minimum wage, maximum hours, and safety and health standards for work on contracts with the federal government.

Prevailing Wages

The average wage paid to workers within a specific area for a given trade or occupation, often determined by government standards for public works projects.

Pay Ration Reporting Policy

A policy requiring companies to disclose the ratio of compensation of their chief executive to the median compensation of their employees.

Dodd-Frank Wall Street Reform

A comprehensive set of financial regulations passed in 2010 in response to the financial crisis, aimed at increasing transparency and accountability in the financial system.

Q23: In the case of a below-market gift

Q28: Even though a client refuses to correct

Q47: Which of the following is a deduction

Q70: Discuss the beneficial tax consequences of an

Q72: If a residence is used primarily for

Q73: Betty purchased an annuity for $24,000 in

Q80: The objective of pay-as-you-go (paygo)is to achieve

Q80: Virginia had AGI of $100,000 in 2012.She

Q104: If personal casualty losses (after deducting the

Q120: Dave is the regional manager for a