Multiple Choice

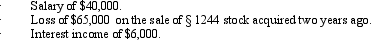

John files a return as a single taxpayer.In 2012,he had the following items:  Determine John's AGI for 2012.

Determine John's AGI for 2012.

Definitions:

Related Questions

Q17: The tax law specifically provides that a

Q17: The statutory dollar cost recovery limits under

Q26: Madison is an instructor of fine arts

Q35: The civil fraud penalty can entail large

Q42: Rex,a cash basis calendar year taxpayer,runs a

Q45: An accrual basis taxpayer who owns and

Q94: Marvin lives with his family in Alabama.He

Q101: Claude's deductions from AGI slightly exceed the

Q102: Alfredo,a self-employed patent attorney,flew from his home

Q114: The cost of a covenant not to