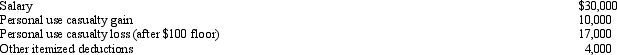

In 2012,Mary had the following items:  Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Assuming that Mary files as head of household (has one dependent child) ,determine her taxable income for the current year.

Definitions:

Family Home

A residence occupied by a family, often offering a sense of security and belonging, and sometimes afforded specific legal protections.

Bankruptcy

A legal proceeding involving a person or business that is unable to repay outstanding debts.

Debts Discharged

The cancellation of a debtor's obligation to pay a debt after fulfilling certain conditions, often under bankruptcy procedures.

Technically Insolvent

A financial state where an entity's liabilities exceed its assets, but it has not yet declared bankruptcy.

Q6: Thelma and Mitch were divorced.The couple had

Q6: Carin,a widow,elected to receive the proceeds of

Q48: Margaret owns land that appreciates at the

Q50: When stock is sold after the record

Q65: Julie was suffering from a viral infection

Q70: Gold Company was experiencing financial difficulties,but was

Q85: During 2012,Eva used her car as follows:

Q104: Federal excise taxes that are no longer

Q125: Under the "one-year rule" for the current

Q150: Under the income tax formula,a taxpayer must