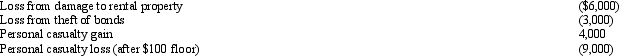

In 2012,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:  Determine the amount of Morley's itemized deduction from the losses.

Determine the amount of Morley's itemized deduction from the losses.

Definitions:

Utility Level

A quantification of the satisfaction or happiness obtained from consuming a set of goods and services.

Food Consumption

The amount of food eaten by individuals or populations, considered in terms of quantity, frequency, and types of food, influencing nutritional status and health.

Clothing Consumption

The action or process of purchasing and using clothing.

Budget Line

A visual chart showing every potential mix of two products that one can buy with a specific amount of money at constant prices.

Q1: On May 2,2012,Karen placed in service a

Q11: Jerry purchased a U.S.Series EE savings bond

Q18: The statutory dollar cost recovery limits under

Q19: In 2012,José,a widower,sells land (fair market value

Q27: Briana lives in one state and works

Q34: The Green Company,an accrual basis taxpayer,provides business-consulting

Q87: In determining whether a debt is a

Q89: When lessor owned leasehold improvements are abandoned

Q103: Nicholas owned stock that decreased in value

Q112: In 2012,Ed is 66 and single.If he