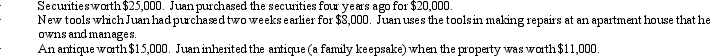

In 2012,Juan's home was burglarized.Juan had the following items stolen:  Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $50,000,determine the amount of his itemized deductions as a result of the theft.

Juan's homeowner's policy had a $50,000 deductible clause for thefts.If Juan's salary for the year is $50,000,determine the amount of his itemized deductions as a result of the theft.

Definitions:

Therapeutic Touch

A form of alternative medicine based on the theory that healers can identify and manipulate the energy field surrounding a person to promote healing.

Energy Fields

In some holistic and alternative medicine practices, invisible fields believed to surround and penetrate the human body, influencing health and healing.

Hydromorphone

A potent opioid analgesic medication used to relieve moderate to severe pain.

Naloxone (Narcan)

A medication used to counter the effects of opioid overdose, rapidly reversing the life-threatening respiratory depression.

Q7: Orange Cable TV Company,an accrual basis taxpayer,allows

Q47: Our tax laws encourage taxpayers to _

Q52: Augie purchased one new asset during the

Q73: The taxpayer is a Ph.D.student in accounting

Q78: Bruce,who is single,had the following items for

Q82: Benita incurred a business expense on December

Q93: If a tax-exempt bond will yield approximately

Q111: Surviving spouse filing status begins in the

Q120: Alfred's Enterprises,an unincorporated entity,pays employee salaries of

Q121: Margaret made a $90,000 interest-free loan to