In 2011,Robin Corporation Incurred the Following Expenditures in Connection with the Development

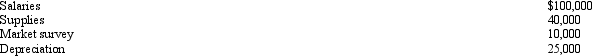

In 2011,Robin Corporation incurred the following expenditures in connection with the development of a new product:

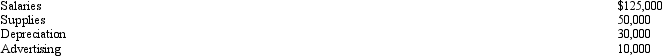

In 2012,Robin incurred the following additional expenditures in connection with the development of the product:

In 2012,Robin incurred the following additional expenditures in connection with the development of the product:

In October 2012,Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures,determine the amount and year of the deduction.

In October 2012,Robin began receiving benefits from the project.If Robin elects to expense research and experimental expenditures,determine the amount and year of the deduction.

Definitions:

Tax Burden

The total amount of tax paid by individuals or businesses, often expressed as a percentage of income or GDP.

Inelastic

Refers to a condition where the demand for a product or service changes very little when there is a change in its price.

Price Elasticities

A measure of how much the quantity demanded or supplied of a good changes in response to a change in its price.

Social Security

A government program that provides financial assistance to retirees, disabled workers, and their families.

Q7: Three years ago,Sharon loaned her sister $30,000

Q15: Jake performs services for Maude. If Jake

Q51: The plant union is negotiating with the

Q69: Logan,Caden,and Olivia are three unrelated parties who

Q73: Benjamin,age 16,is claimed as a dependent by

Q93: ABC Corporation mails out its annual Christmas

Q95: Tommy,an automobile mechanic employed by an auto

Q108: A father cannot claim a casualty on

Q112: In the case of an office in

Q141: For purposes of the § 267 loss