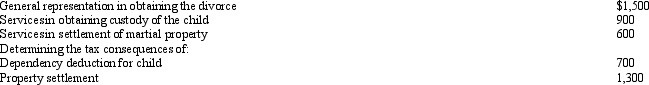

Velma and Josh divorced.Velma's attorney fee of $4,000 is allocated as follows:  Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Definitions:

Driving Ability

The capability to operate a motor vehicle, including the physical and cognitive skills required for safe and effective driving.

Text Messages

Electronic messages sent over a cellular network from one cell phone to another by typing words, often abbreviated.

Restless Leg Syndrome

A neurological disorder characterized by an irresistible urge to move the legs, often accompanied by uncomfortable sensations.

Control Group

A group in an experiment or study that does not receive the experimental treatment, used as a baseline to compare the effects of the treatment.

Q7: Since an abandoned spouse is treated as

Q14: During the past two years,through extensive advertising

Q24: Faith just graduated from college and she

Q39: A cash basis taxpayer can deduct the

Q43: Under what circumstances may a taxpayer deduct

Q43: Motel buildings are classified as residential rental

Q50: Susan is a sales representative for a

Q90: Under the alternative depreciation system (ADS),the half-year

Q90: Married taxpayers who file a joint return

Q104: In 2012,Warren sold his personal use automobile