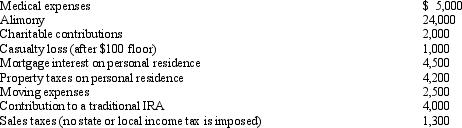

Austin,a single individual with a salary of $100,000,incurred and paid the following expenses during the year:

Calculate Austin's deductions for AGI.

Calculate Austin's deductions for AGI.

Definitions:

Ideal Standard

Benchmarks for optimal performance under perfect operating conditions, used in cost accounting to set budget targets.

Rigorous

Characterized by a strict attention to detail; thorough and exacting.

Standard

A set of guidelines or principles established as a basis for comparison or measurement in quality assessment, production, and compliance.

Budget

A financial plan for a defined period, outlining an organization's projected revenues, expenses, and capital expenditures.

Q12: Two-thirds of treble damage payments under the

Q17: Debby,age 18,is claimed as a dependent by

Q20: For self-employed taxpayers,travel expenses are not subject

Q25: Last year,Green Corporation incurred the following expenditures

Q52: Ed is divorced and maintains a home

Q79: Jim and Nora,residents of a community property

Q85: A shareholder's basis in property received as

Q87: In determining whether a debt is a

Q92: Freddy purchased a certificate of deposit for

Q100: The president of Silver Corporation is assigned