Walter sells land with an adjusted basis of $175,000 and a fair market value of $160,000 to his mother,Shirley,for $160,000.Walter reinvests the proceeds in the stock market.Shirley holds the land for one year and a day and sells it in the marketplace for $169,000.

Definitions:

Entrepreneurial Process

The sequence of steps and stages that an individual or team undergoes in launching and establishing a new business venture, from conception to realization.

Balancing Act

The effort to maintain stability between different forces, demands, or aspects in a situation.

Sustainable Venture

A business endeavor designed to operate while keeping environmental, social, and financial viability in mind, ensuring long-term resilience and success.

Economic

Pertaining to the production, distribution, and consumption of goods and services, and the management of wealth.

Q1: A taxpayer who lives and works in

Q9: Hazel,a solvent individual but a recovering alcoholic,embezzled

Q9: Alimony recapture may occur if there is

Q34: Norm purchases a new sports utility vehicle

Q61: The tax law allows,under certain conditions,deferral of

Q94: Assuming a taxpayer qualifies for the exclusion

Q107: If a business retains someone to provide

Q114: Why was the domestic production activities deduction

Q114: Once the actual cost method is used,a

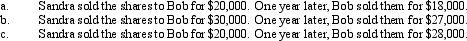

Q137: In 2012,Pierre had the following transactions: <img