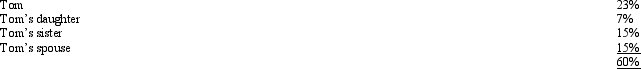

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Taste Receptor

Specialized sensory cells located on the tongue that are responsible for detecting the five basic taste types: sweet, sour, salty, bitter, and umami.

Menstrual Cycles

The regular natural change that occurs in the female reproductive system that makes pregnancy possible, typically lasting about 28 days.

Pheromones

Chemical substances produced and released into the environment by animals, including humans, affecting the behavior or physiology of others of its species.

Hearing Loss

A decrease in the ability to perceive sounds, ranging from mild to profound, which may affect one or both ears.

Q39: For tax purposes,"travel" is a broader classification

Q62: Sarah,a majority shareholder in Teal,Inc.,made a $200,000

Q87: Rod paid $950,000 for a new warehouse

Q106: The Purple & Gold Gym,Inc.,uses the accrual

Q107: The Perfection Tax Service gives employees $12.50

Q112: Iris,a calendar year cash basis taxpayer,owns and

Q121: Margaret made a $90,000 interest-free loan to

Q125: The amount of the dividends received deduction

Q136: A worker may prefer to be classified

Q145: A child who has unearned income of