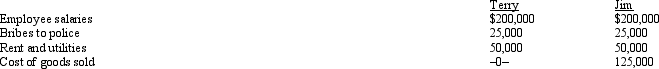

Terry and Jim are both involved in operating illegal businesses.Terry operates a gambling business and Jim operates a drug running business.Both businesses have gross revenues of $500,000.The businesses incur the following expenses.  Which of the following statements is correct?

Which of the following statements is correct?

Definitions:

Debt Readjustment

A financial process where terms of debt are modified, often to provide relief to the debtor by reducing interest rates, extending payment schedules, or reducing the principal amount owed.

Creditors

Individuals or entities that loan money or extend credit to others.

Chapter 12 Bankruptcy

A type of bankruptcy specifically designed for family farmers and fishermen, providing for debt restructuring.

Farm Expenses

Costs associated with the operation, maintenance, and management of a farm, including but not limited to feed, seed, fertilizer, and equipment maintenance.

Q8: The Royal Motor Company manufactures automobiles.Employees of

Q12: Juan,was considering purchasing an interest in a

Q58: Edna lives and works in Cleveland.She travels

Q74: Dove Corporation pays for a trip to

Q100: Nick Lee is a linebacker for the

Q104: In 2012,Khalid was in an automobile accident

Q108: If a taxpayer cannot satisfy the three-out-of-five

Q111: Calculate the net income includible in taxable

Q126: Graham,a CPA,has submitted a proposal to do

Q131: Henry entertains several of his key clients