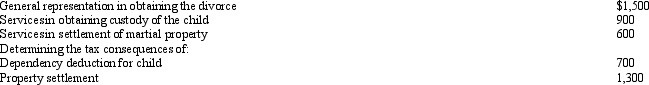

Velma and Josh divorced.Velma's attorney fee of $4,000 is allocated as follows:  Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Of the $4,000 Velma pays to her attorney,the amount she may deduct as an itemized deduction is:

Definitions:

Net Seller

An individual or entity that sells more than it purchases in a given market, often resulting in a net inflow of funds.

Net Buyer

An entity or individual that purchases more of a commodity or asset than they sell in a specific period.

Normal Goods

Goods for which demand increases when consumer income increases, and falls when consumer income decreases, all else being equal.

Wage Rate

The amount of money that is paid to a worker for a specified quantity of labor, usually expressed per hour or piece of work done.

Q3: In January 2012,Tammy purchased a bond due

Q51: When the kiddie tax applies,the child need

Q61: Nikeya sells land (adjusted basis of $120,000)to

Q62: In 2012,Bob's unincorporated business has a net

Q79: The individual shareholder of a corporation being

Q92: Andrew,who operates a laundry business,incurred the following

Q101: The basis of cost recovery property must

Q102: Ethan had the following transactions during 2012:<br>

Q112: In the case of an office in

Q145: Taxpayers who want both limited liability and