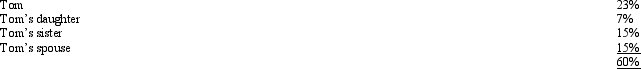

The stock of Eagle,Inc.is owned as follows:

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Tom sells land and a building to Eagle,Inc.for $212,000.His adjusted basis for these assets is $225,000.Calculate Tom's realized and recognized loss associated with the sale.

Definitions:

Microorganisms

Tiny living organisms, often microscopic, such as bacteria, viruses, fungi, and protozoa, which can be beneficial or harmful.

SSI Classification

A system used to classify surgical site infections (SSIs) based on their severity and the specific area of the body affected.

Fascia

A structure that covers entire skeletal muscles and separates them from each other.

Muscle

A tissue in the body capable of contraction, which enables movement of the body and maintains posture.

Q28: If a vacation home is classified as

Q36: The concept of depreciation assumes that the

Q75: Clara,age 68,claims head of household filing status.If

Q79: For tax purposes, a statutory employee is

Q98: Matilda works for a company with 1,000

Q106: Austin,a single individual with a salary of

Q110: Al single,age 60,and has gross income of

Q115: Christie sued her former employer for a

Q115: Last year,taxpayer had a $10,000 nonbusiness bad

Q155: Under the check-the-box Regulations,an entity is allowed