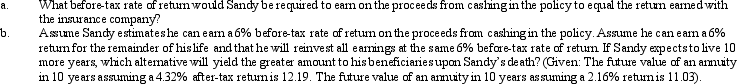

Sandy is married,files a joint return,and expects to be in the 28% marginal tax bracket for the foreseeable future.All of his income is from salary and all of it is used to maintain the household.He has a paid-up life insurance policy with a cash surrender value of $100,000.He paid $60,000 of premiums on the policy.His gain from cashing in the life insurance policy would be ordinary income.If he retains the policy,the insurance company will pay him $3,000 (3%)interest each year.Sandy thinks he can earn a higher return if he cashes in the policy and invests the proceeds.

Definitions:

Speech Sounds

The auditory symbols used in language communication, produced by the movement of the speech apparatus.

Axons

Long, threadlike parts of nerve cells along which impulses are conducted from the cell body to other cells.

Neurons

Specialized cells in the nervous system that transmit information to other nerve cells, muscle, or gland cells.

Impulses

Sudden, involuntary urges to act, often without premeditation and sometimes contrary to individual's conscious wishes or societal norms.

Q17: If a partnership interest is received in

Q22: How are combined business/pleasure trips treated for

Q53: Gary,who is an employee of Red Corporation,has

Q53: Tom acquired a used five-year class asset

Q84: If a vacation home is determined to

Q84: In connection with the office in the

Q93: As of January 1,2012,Crimson Corporation,a calendar year

Q110: Turner,a successful executive,is negotiating a compensation

Q133: A decrease in a taxpayer's AGI could

Q150: Kitty runs a brothel (illegal under state