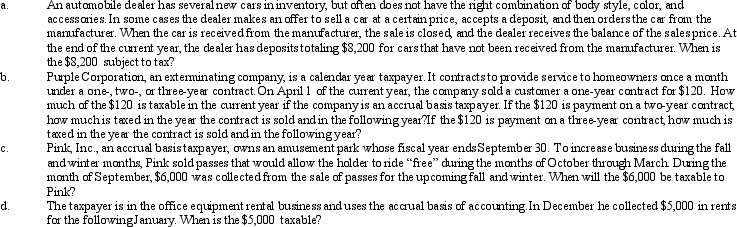

Determine the proper tax year for gross income inclusion in each of the following cases.

Definitions:

Market Supply And Demand

The economic model that explains the interaction between the supply of goods and services and the demand for them, determining their market prices.

Marginal Cost

A rise in the cumulative expenses associated with the production of an extra unit.

Economic Rent

Extra income earned by a factor of production due to its limited supply or unique properties, over and above its opportunity cost.

Output Tax

A tax levied on the quantity of production or output generated by a company, as opposed to income or profit.

Q7: Rowena is the sole shareholder of Rail,a

Q37: Katrina,age 16,is claimed as a dependent by

Q82: The annual increase in the cash surrender

Q87: In determining whether a debt is a

Q103: Discuss the reason for the inclusion amount

Q107: In order to claim a dependency exemption

Q116: On November 1,2012,Bob,a cash basis taxpayer,gave Dave

Q119: The period in which an accrual basis

Q122: Tim and Janet were divorced.Their only marital

Q142: An S corporation makes a $20,000 cash