Multiple Choice

Millie,age 80,is supported during the current year as follows:  During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

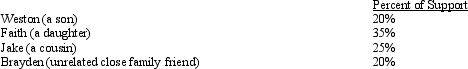

During the year,Millie lives in an assisted living facility.Under a multiple support agreement,indicate which parties can qualify to claim Millie as a dependent.

Definitions:

Related Questions

Q17: Debby,age 18,is claimed as a dependent by

Q19: Mabel is age 65 and lives on

Q35: Emelie and Taylor are employed by the

Q39: Samuel,age 53,has a traditional deductible IRA with

Q43: Nick negotiates a $4.5 million contract per

Q57: Ebony,Inc.,uses the three-to-seven year graded vesting approach

Q64: An employer obtains a tax deduction at

Q80: If a company uses the LIFO inventory

Q111: Jena is a full-time undergraduate student at

Q148: Which,if any,of the following is a deduction