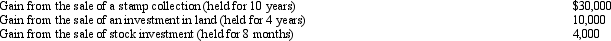

Perry is in the 33% tax bracket.During 2012,he had the following capital asset transactions:  Perry's tax consequences from these gains are as follows:

Perry's tax consequences from these gains are as follows:

Definitions:

Postoperative Pain

Pain experienced by patients after undergoing surgical procedures, often requiring management with medication or other therapies.

Lung Cancer

A type of cancer that originates in the lungs, characterized by uncontrollable cell growth in lung tissue.

Visceral

Relating to the internal organs of the body, especially those within the chest or abdomen.

Phantom Pain

Pain perceived in an area of the body that has been amputated or is missing.

Q1: For purposes of determining the partnership's tax

Q38: Pursuant to a complete liquidation,a corporation sells

Q60: Mel was the beneficiary of a $45,000

Q62: Sarah,a majority shareholder in Teal,Inc.,made a $200,000

Q66: Yvonne exercises incentive stock options (ISOs)for 100

Q82: What statement is false with respect to

Q87: When can a taxpayer not use Form

Q92: Sally and Ed each own property with

Q96: A cash basis taxpayer who charges an

Q121: Beige,Inc.,an airline manufacturer,is conducting negotiations for the