Multiple Choice

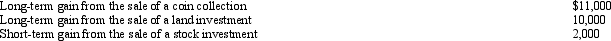

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2012:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

Definitions:

Related Questions

Q2: Drab Corporation,a calendar year and cash basis

Q9: In determining a partner's basis in the

Q16: Barbara was injured in an automobile accident.She

Q24: For an activity classified as a hobby,the

Q28: Louise works in a foreign branch of

Q66: In the case of a below-market loan

Q69: If a taxpayer operated an illegal business

Q102: Which would not be considered an advantage

Q121: To improve its liquidity,the shareholders of Spoonbill

Q149: Currently,the top income tax rate in effect