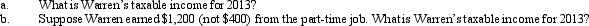

Warren,age 17,is claimed as a dependent by his father.In 2012,Warren has dividend income of $1,500 and earns $400 from a part-time job.

Definitions:

Net Operating Income

A company's total earnings from its operations, excluding non-operating income and expenses, interest, and taxes.

Absorption Costing

This accounting strategy entails calculating a product's cost by including all costs related to its manufacturing, comprising direct materials, direct labor, and all categories of manufacturing overhead, both variable and fixed.

Variable Costing

A costing method that includes only variable production costs (direct materials, direct labor, and variable overhead) in product costs, excluding fixed overhead.

Net Operating Income

Profit generated from a company’s core business operations, excluding deductions of interest and taxes.

Q23: Amos,a shareholder-employee of Pigeon,Inc.,receives a $400,000 salary.The

Q68: Yvonne exercises incentive stock options (ISOs)for 100

Q81: Robyn rents her beach house for 60

Q84: Sam was unemployed for the first two

Q87: Linda delivers pizzas for a pizza shop.On

Q90: Married taxpayers who file a joint return

Q91: Cash received by an individual:<br>A) Is not

Q96: Andrew owns 100% of the stock of

Q123: In some community property states,the income from

Q150: Under the income tax formula,a taxpayer must