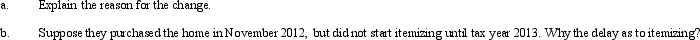

When filing their Federal income tax returns,the Youngs always claimed the standard deduction.After they purchased a home,however,they started to itemize their deductions from AGI.

Definitions:

Asset

Resources owned by an individual or business that have economic value and can be used to meet debts, commitments, or legacies.

Prepaid Rent Expense

An accounting term for rent payments made in advance of the rental period, recorded as an asset on the balance sheet until the period of use.

Adjustment

The process of making entries to correct accounts or to allocate amounts properly at the end of an accounting period.

Office Equipment

Assets like computers, desks, chairs, and printers that are used in an office setting for the operation of the business.

Q9: In determining a partner's basis in the

Q50: A C corporation in the manufacturing business

Q51: When the kiddie tax applies,the child need

Q54: Under the terms of a divorce agreement,Lanny

Q68: Yvonne exercises incentive stock options (ISOs)for 100

Q74: Before a tax bill can become law,it

Q102: Ethan had the following transactions during 2012:<br>

Q118: Meg,age 23,is a full-time law student and

Q138: In 2011,Creeper Corporation had a $4,000 net

Q143: Marvin spends the following amounts on a