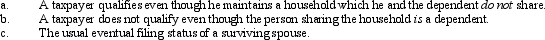

Regarding head of household filing status,comment on the following:

Definitions:

Accumulated Depreciation

The total amount of depreciation expense that has been recorded against a fixed asset since it was put into use.

Cash

Money in the form of currency that is used to conduct transactions.

Accumulated Depreciation

The total amount of depreciation for a fixed asset that has been charged to expense since that asset was acquired and put into use.

Q3: Section 1245 may apply to depreciable farm

Q15: Regarding the rules applicable to filing of

Q24: As a general rule: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4131/.jpg" alt="As

Q31: Mark is a cash basis taxpayer.He is

Q33: Yvonne exercises incentive stock options (ISOs)for 100

Q45: Which of the following rules are the

Q50: When stock is sold after the record

Q92: The taxpayer does need the IRS's permission

Q104: A cash basis taxpayer purchased a certificate

Q143: The AMT tax rate applicable to corporations