Multiple Choice

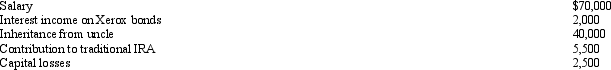

During 2012,Esther had the following transactions:  Esther's AGI is:

Esther's AGI is:

Definitions:

Related Questions

Q10: Katelyn is divorced and maintains a household

Q12: Two-thirds of treble damage payments under the

Q21: Which statement is incorrect with respect to

Q25: For dependents who have income,special filing requirements

Q30: How does the domestic production activities deduction

Q36: Turquoise Company purchased a life insurance policy

Q57: The realization requirement gives an incentive to

Q137: In order to get the Cardinal Corporation

Q146: An increase in a taxpayer's AGI will

Q160: Nick,Kristin,Spencer,Giselle,and Herbert are equal shareholders in Cuckoo