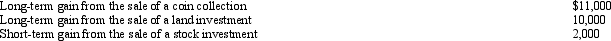

Kirby is in the 15% tax bracket and had the following capital asset transactions during 2012:  Kirby's tax consequences from these gains are as follows:

Kirby's tax consequences from these gains are as follows:

Definitions:

Very Elastic

Refers to a situation in which the demand or supply for a product changes significantly in response to price changes, indicating high sensitivity.

Elastic Demand Curve

A demand curve characterized by a high sensitivity of quantity demanded to changes in price, indicating that a small price change results in a large change in quantity demanded.

Heating Oil

A low viscosity, liquid petroleum product used as a fuel for furnaces or boilers in buildings.

New Automobile

A recently manufactured vehicle intended for personal transportation, featuring the latest technology and design.

Q17: In December 2012,Todd,a cash basis taxpayer,paid $1,200

Q25: Which of the following are deductions for

Q47: Betty,a sole shareholder,rents property to her corporation.The

Q63: The accrual method generally is required to

Q71: Depending on the nature of the expenditure,expenses

Q75: Janice is single,had gross income of $38,000,and

Q94: Assuming a taxpayer qualifies for the exclusion

Q109: For a vacation home to be classified

Q120: As of January 1,2012,Owl Corporation (a calendar

Q153: During 2012,Addison has the following gains and