Aiden and Addison form Dove Corporation with the following investments:  Dove issues stock equally to Aiden and Addison.One of the tax consequences of these transfers is:

Dove issues stock equally to Aiden and Addison.One of the tax consequences of these transfers is:

Definitions:

Community Mental Health

A field of medicine that focuses on addressing and treating mental health disorders within community settings, aiming to improve access to mental health care for all individuals.

Autonomy

The right or condition of self-government, or making decisions independently.

Medication Non-Adherence

The behavior of not taking prescribed medications as directed by a healthcare provider, which can negatively affect the effectiveness of treatment.

Discharge Planning

A process used by healthcare providers to prepare for a patient's move from the hospital to another setting, such as home or a rehabilitation facility.

Q24: Ryan has the following capital gains and

Q38: Involuntary conversion gains may be deferred if

Q45: An accrual basis taxpayer who owns and

Q47: Our tax laws encourage taxpayers to _

Q55: If a subsidiary is liquidated under §

Q60: Willie is the owner of vacant land

Q65: Paul is a participant in a qualified

Q65: Which items tell taxpayers the IRS's reaction

Q79: Generally,an advantage to using the cash method

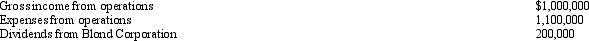

Q124: For various reasons,Bill would like to incorporate