Two unrelated,calendar year C corporations have the following taxable income for the current year:  Magenta Corporation is a qualified personal service corporation.Based on these facts,their corporate tax liability is:

Magenta Corporation is a qualified personal service corporation.Based on these facts,their corporate tax liability is:

Definitions:

Total Surplus

The combined total of consumer and producer surplus, signifying the overall net advantage to society derived from a market transaction.

Tariff Revenue

Income that a government earns from imposing tariffs on imported goods.

Domestic Consumers

Individuals or households that consume goods and services within their own country, as opposed to purchasing imported goods.

Domestic Producers

Entities within a country that produce goods and services for the local market.

Q14: Which publisher offers the United States Tax

Q26: What is a Technical Advice Memorandum?

Q34: Starling Corporation is a calendar year S

Q67: Blue Mart operates a large chain of

Q82: The following citation is correct: Larry<br>G. Mitchell,

Q84: In applying the lower of cost or

Q100: The buyer and seller have tentatively agreed

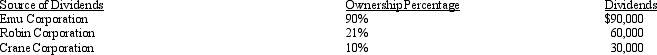

Q122: Four unrelated,calendar year corporations are formed on

Q145: A child who has unearned income of

Q147: Spencer owns 50% of the stock of