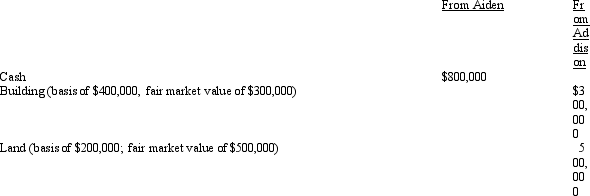

Shrike Corporation is liquidated and its assets are distributed to its 10 equal and unrelated individual shareholders.The assets distributed are as follows:  One of the tax consequences of the liquidating distribution is:

One of the tax consequences of the liquidating distribution is:

Definitions:

Sales Salaries Expense

The total cost incurred for salaries, wages, and commissions paid to sales personnel, reflecting a company's investment in its sales force.

Work in Process

Inventory consisting of items that are in the process of being produced but are not yet finished goods.

Direct Materials Cost

The cost of raw materials directly used in the production of goods, easily traceable to the final product.

Work in Process

Inventory consisting of items that are in the production process but are not yet completed.

Q23: Under a nonqualified stock option (NQSO)plan which

Q24: Doug and Pattie received the following interest

Q32: Karen,an accrual basis taxpayer,sold goods in December

Q40: April,a calendar year taxpayer,is a 40% partner

Q63: Flora Company owed $95,000,a debt incurred to

Q71: If a person has funds from sources

Q76: Albert is in the 35% marginal tax

Q80: Under a defined benefit plan,the annual benefit

Q86: Under the Swan Company's cafeteria plan,all full-time

Q108: James,a cash basis taxpayer,received the following compensation